Can you spot fraudsters online?

Find out if you can avoid traps set by fraudsters for Black Friday sales.

132 articles

Find out if you can avoid traps set by fraudsters for Black Friday sales.

Online dating fraud cost victims millions last year. Be vigilant and protect yourself!

The key danger is the method the Hummer uses to achieve its goals. It roots a device and gains administrator’s privileges to install unauthorized software of its own discretion

Criminals are stealing money from freelancers — by offering them a job.

88% of companies are willing to pay extra in order to work with a bank that has a strong security policy and a good security track record, new survey by Kaspersky Lab shows.

Sooner or later each user of the internet will face a trick or trap. Here’s the list of the most widespread ones. Forewarned is forearmed!

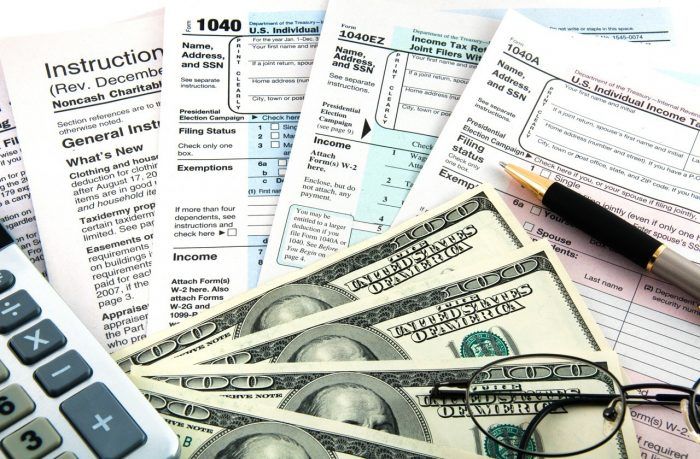

Tax season means that more folks than the IRS are after your money.

So your social media photos are public, great. Ever wonder what could happen when they get stolen?

The latest research by Kaspersky Lab and B2B International shows that 33% of financial services organizations don’t offer customers a secure channel for all of their online payments, despite the fact that most have noticed a significant rise in customers making online financial transactions.

A botnet behind Dridex, a sophisticated banking malware stealing credentials of online bank accounts worldwide, are down.

Kaspersky Lab recently launched an online quiz “Are you cyber-savvy”, and the first results are in. While oriented towards end-users, this quiz’s results may serve as another alert for businesses, especially those that are online-based.

The results of the recent IT Security Risks Survey 2015 show that half of banks and payment systems prefer to handle cyberincidents when they happen, rather than invest in tools to prevent them.

Kaspersky Lab experts detected a sly scheme that allows fraudsters to steal personal data without your login and password.

In the dead of the night, a guy called my Mom and said in a weary voice: “Mom, I got into an accident. I’m in trouble. I’ll pass the phone to the officer, he’ll fill you in”. Here’s what happened next.

Fraudsters hacked Skype and tricked people from a contact list to send them about $5,000 over the course of a few days. Skype support, local banks and the police refused to do anything.

One dollar lesson is a new interactive project by Kaspersky Lab that aims to help you stay protected from online money frauds. Learn three simple lessons right now!

WhatsApp has finally released a Web version of its popular mobile messaging service. We take a look at it from the security perspective.

Whether you’re buying or selling a secondhand Apple device, you can be fooled by criminals. We have gathered tips on how to minimize your chances of being taken by such frauds.

One morning when I was in a hurry to get to work, everything went wrong in an instant: an SMS message alerted me to an $80 charge to my credit card for a purchase that I never made.

Interpol just released an alert regarding cyber-attacks targeting multiple ATMs around the world. During the course of a forensic investigation performed by Kaspersky Lab, researchers discovered a piece of malware infecting ATMs that allowed attackers to empty the cash machines via direct manipulation, stealing millions of dollars.

Few companies are interested in protecting their users’ endpoint devices, even though it’s one of the most vulnerable points in the financial transaction chain. At the same time, users expect payment operators to reimburse their funds in instances of successful fraud.