The Problem

At present, even very small companies store information that could cause irreparable damage to their financial future if it fell into the wrong hands. An example of this could be a database containing customer information that if leaked, could compromise the entire business.

Criminals can take advantage of the low level of protection on employees’ workstations. When the same computers are used for both work and personal time, the chances for a piece of banking malware to infect computers can grow significantly.

E-banking systems are widely used in small organizations, but any procedures to ensure the security of payment transactions are usually either absent or imperfect. Phishing attacks and banking malware specifically target payment information of such companies while they interact with online banking systems. The accounts of small and often not properly protected companies may hold an impressive amount of cash.

The Solution

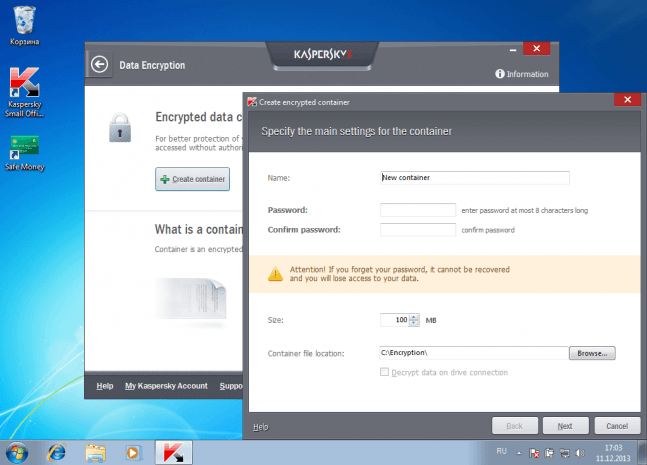

In order to secure valuable information from falling into the wrong hands, it is necessary to ensure the data’s safety. Encryption helps in avoiding critical data leaks in case of theft, as well as protecting it from unauthorized access by hackers and malware. Kaspersky Small Office Security provides encryption integrated with workstation security technologies.

All organizations possess valuable information assets like databases with customers’ data, confidential documents, files of various applications, etc. Unauthorized access to the computer storage of important information may lead to tragic consequences for a business.

Kaspersky Small Office Security offers the option to encrypt files and folders. For example, valuable accounting files may be placed in a separate container and encrypted, and the chief accountant knows the password to decrypt the contents. One of the advantages of containerization is the mobility of the encrypted container: valuable data is inaccessible to outsiders and is safely stored on removable drives.

To protect accounts on various services, like online banking systems or internal resources of the organization, you can use Password Manager. This technology allows you to securely store passwords in a special database. The password database itself is encrypted as well. You should have a master password to gain access to it.

For each workstation and for groups of users, you can use separate databases for storing passwords. For example, the accountant stores passwords to payment systems and e-banking in his database, and only he and the CEO will know the master password. The CEO has his personal vault of passwords and his own master password to access it. By encrypting accounts, companies can significantly reduce the risk of employee data leaks.

data protection

data protection

Tips

Tips