Stuxnet’s “hole”: the vulnerability is still around

Four years after the discovery of the Stuxnet worm, the primary vulnerability it had been exploiting is still around. This is mainly the problem of poorly maintained Windows XP PCs and servers, most likely inhabited by worms. In the interconnected world a neglected PC or a server is a possible problem for many people.

PC neglect

PC neglect

IT education

IT education

e-commerce fraud

e-commerce fraud

analysis

analysis

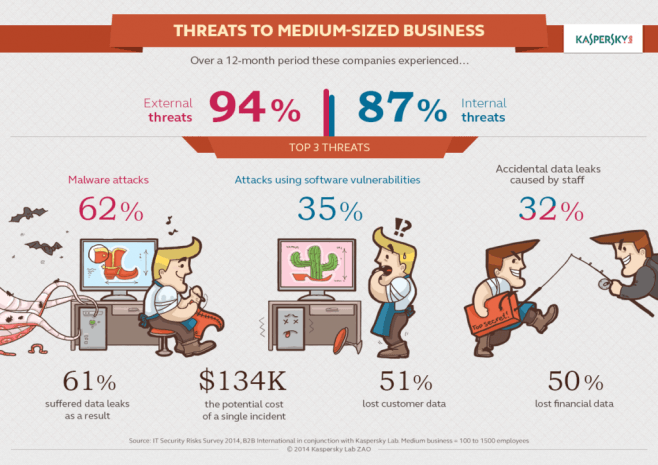

business IT security

business IT security

botnets

botnets

backdoor

backdoor